Navigating Your Financial Journey: Tips for Money Management and Wealth Building

February 23, 2025 | by npaul17@gmail.com

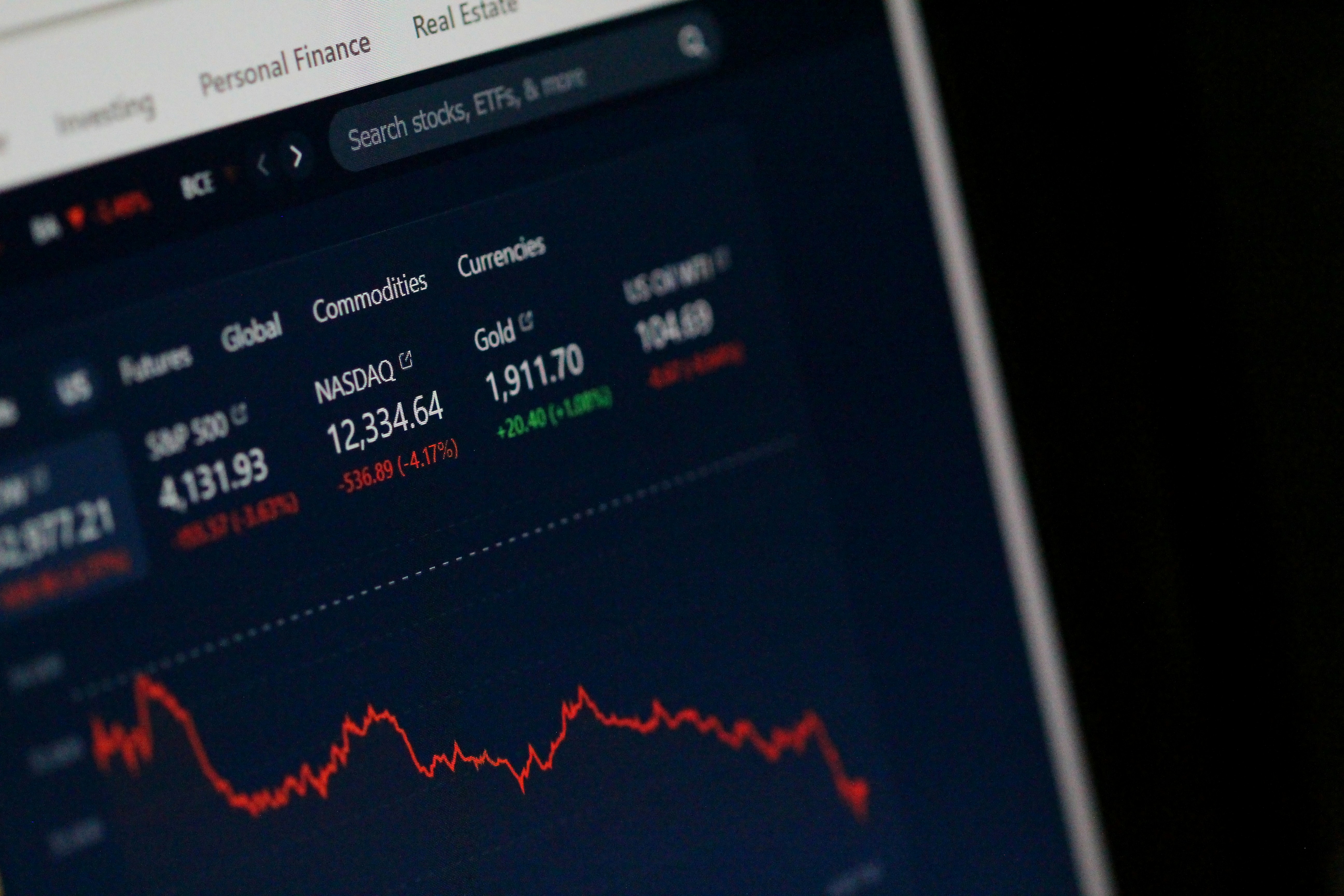

Photo by Mathieu Stern on Unsplash

Photo by Mathieu Stern on Unsplash Mastering the Art of Budgeting: Essential Techniques for Success

Budgeting is an essential element of effective personal finance management. It involves planning and allocating resources to ensure that one can meet both immediate expenses and long-term financial goals. Mastering this art requires understanding various budgeting techniques that cater to different lifestyle needs and financial situations. Among the most popular methods are the 50/30/20 rule, zero-based budgeting, and the envelope system.

The 50/30/20 rule is a straightforward approach to budgeting. This method allocates 50% of your income to essential needs, 30% to discretionary spending, and 20% to savings or debt repayment. This simple distribution helps maintain a balanced budget and allows for both responsible spending and saving.

On the other hand, zero-based budgeting is more rigorous. This approach requires you to assign every dollar of your income to specific expenses or savings, effectively creating a budget that reaches zero at the end of the month. This method encourages meticulous tracking of expenses, as it compels individuals to justify each expenditure, fostering accountability.

The envelope system is another effective budgeting method that is particularly useful for managing cash expenses. In this approach, you allocate a fixed amount of cash to various categories, such as groceries or entertainment, placing them in labeled envelopes. Once the cash in an envelope is depleted, no further spending is allowed in that category, thus preventing overspending.

To create a personalized budget, first assess your income and fixed expenses. Tracking expenses through budgeting apps or spreadsheets can simplify this process and provide insights into spending habits. Regularly reviewing your budget will allow you to make necessary adjustments, ensuring that you remain on track to achieve your financial objectives. By implementing these techniques, you can confidently navigate your financial journey and work towards sustainable wealth building.

Strategizing Savings and Investments: Building a Secure Future

Effective money management is crucial for anyone looking to navigate their financial journey successfully. One of the fundamental strategies in this realm is to prioritize savings and investments to grow wealth steadily over time. An essential step in this process is establishing an emergency fund, which is a safety net that can cover unexpected expenses without derailing long-term financial goals. Financial experts typically recommend saving three to six months’ worth of living expenses to ensure adequate coverage.

To boost savings effectively, consider automating transfers to savings accounts as part of a financial strategy. By setting up automatic transfers on a scheduled basis, individuals can save consistently without the temptation to spend the funds. Furthermore, utilizing high-yield savings accounts allows for the growth of savings through better interest rates, thereby enhancing the overall savings potential. This tactic is especially beneficial for short-term goals while maintaining liquidity.

When it comes to investing, a myriad of options is available, including stocks, bonds, mutual funds, and retirement accounts like IRAs or 401(k)s. Each investment option carries its own risk, which should align with an individual’s risk tolerance and financial goals. It is imperative to diversify investments to balance potential returns against the risk involved effectively. Understanding asset allocation—how much to invest in different asset classes—plays a crucial role in managing risk and maximizing returns over time.

Additionally, the concept of compounding interest cannot be overlooked. Simply put, it is the process of earning interest on interest, which can significantly amplify wealth growth over the long term. By starting early and investing consistently, individuals can take full advantage of this powerful financial principle. As you embark on your financial journey, balance your savings and investments to pave the way for a secure and prosperous future.

RELATED POSTS

View all