Navigating Your Financial Future: Insights for Smart Money Management

February 23, 2025 | by npaul17@gmail.com

Photo by Sincerely Media on Unsplash

Photo by Sincerely Media on Unsplash Empowering Financial Literacy: The Foundation of Smart Money Management

Financial literacy serves as a vital cornerstone for effective personal finance management. It encompasses a range of concepts, terminologies, and skills necessary for individuals to navigate their financial landscape confidently. Understanding these essential components enables individuals to make informed decisions about budgeting, saving, investing, and debt management.

At its core, budgeting is the process of creating a plan to manage income and expenses effectively. By tracking monthly income alongside fixed and variable expenses, individuals can allocate funds toward essential needs while setting aside amounts for savings and discretionary spending. A well-structured budget can serve as a roadmap, helping individuals avoid overspending and ensuring they live within their means.

Following budgeting, it is crucial to explore the various types of savings accounts available. Traditional savings accounts, high-yield savings accounts, and certificates of deposit each offer distinct benefits and limitations, tailored to different financial goals. For instance, a high-yield savings account typically provides a higher interest rate than a traditional savings account, allowing funds to grow more rapidly. Familiarity with these options equips individuals with the knowledge needed to optimize their savings strategy.

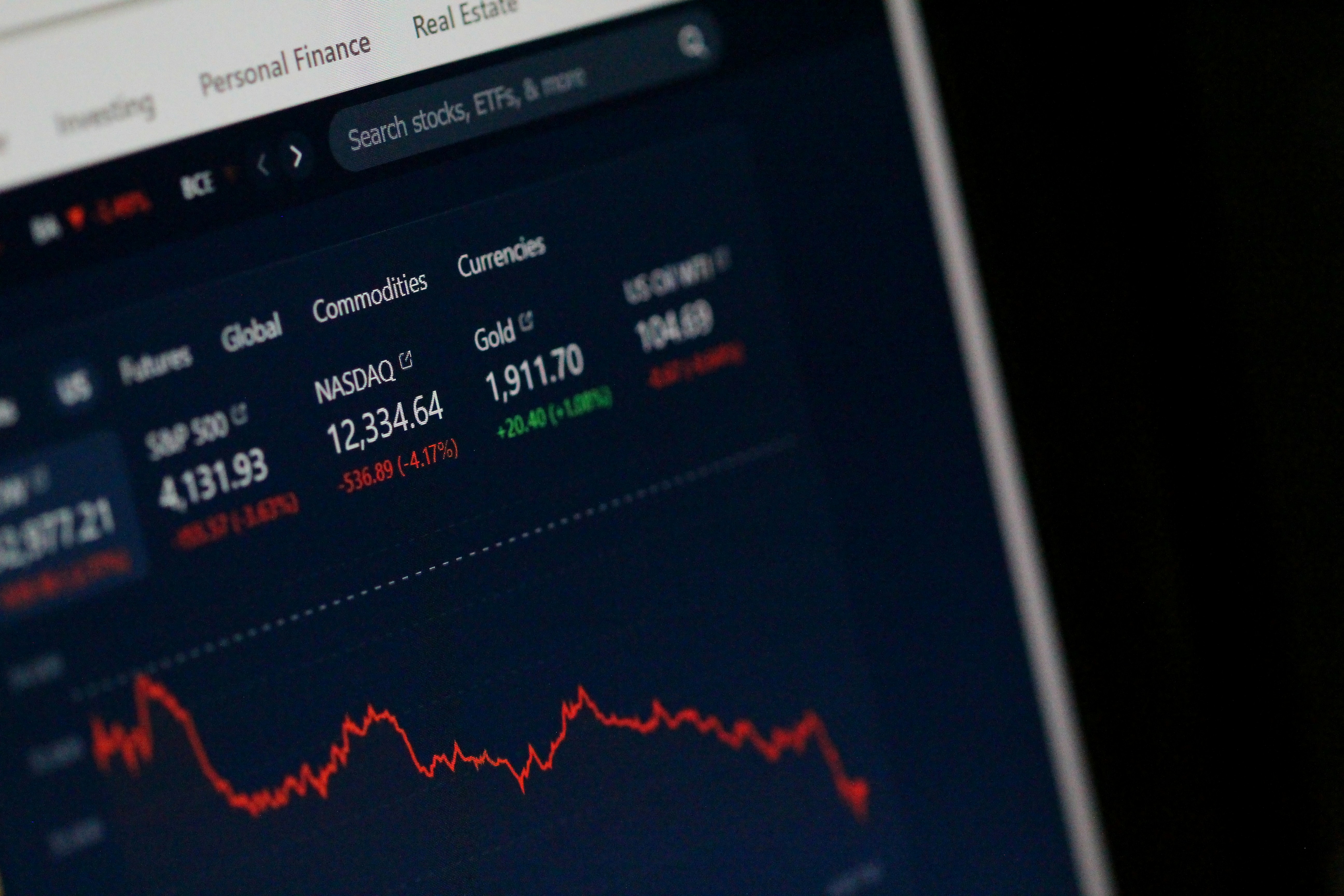

In addition to savings, understanding common investment vehicles is vital for building wealth. Stocks, bonds, mutual funds, and exchange-traded funds (ETFs) are among the most prevalent investment options. Each comes with its own risk profile and potential return on investment, making it essential for individuals to research and align their choices with their financial objectives and risk tolerance.

Lastly, mastering debt management strategies is essential for financial health. Techniques such as the snowball method or the avalanche method can help individuals systematically pay down debt while minimizing interest payments. Recognizing the difference between good debt and bad debt further aids in maintaining financial stability. By equipping themselves with knowledge in these areas, individuals enhance their financial literacy, ultimately empowering them to manage their money more effectively.

Practical Strategies for Financial Success: Tips to Enhance Your Wealth

A sound financial future is often built on practical strategies that promote smart money management. To enhance your wealth, it is vital to begin with a comprehensive budget. This will serve as your financial roadmap, allowing you to track income, expenses, and savings. Start by documenting all sources of income and monthly expenditures, categorizing them into fixed and variable costs. Once you have a clear overview, set a realistic spending limit to avoid overspending and allocate funds towards savings. Regularly reviewing and adjusting your budget can help you stay on track.

Savings are an integral part of wealth enhancement. Consider implementing the “50/30/20” rule, where 50% of your income goes towards needs, 30% towards wants, and 20% towards savings and debt repayment. Establishing an emergency fund is critical; aim to save three to six months’ worth of living expenses. You can achieve this goal by automating your savings—set up a direct deposit into a separate savings account to ensure that a portion of your income is automatically saved before you spend.

Investment is another avenue for growing wealth. Familiarize yourself with various investment vehicles that align with your risk tolerance. If you are risk-averse, consider low-risk options such as bonds or high-yield savings accounts. Alternatively, if you are comfortable with risk, explore stocks or mutual funds, which can yield higher returns over the long term. Diversification helps to mitigate risk, so spreading investments across different asset classes is wise.

Lastly, effective debt management is crucial for financial well-being. Consolidating loans can ease the burden of multiple payments, while prioritizing high-interest debts first can save money in the long run. Implementing these strategies in a systematic way can significantly improve your financial health, paving the way for a secure financial future.

RELATED POSTS

View all