Mastering Personal Finance: Your Guide to Financial Freedom

February 23, 2025 | by npaul17@gmail.com

Photo by Sincerely Media on Unsplash

Photo by Sincerely Media on Unsplash Building a Solid Financial Foundation

Establishing a solid financial foundation is essential for achieving long-term financial wellness. The first step toward effective personal finance management is creating a realistic budget that reflects one’s income and expenses. A well-structured budget allows individuals to understand their cash flow better, prioritize their financial responsibilities, and curb unnecessary expenditures. Utilizing budgeting apps can enhance this process by simplifying tracking and providing a clear overview of spending habits.

Alongside budgeting, understanding the significance of saving is paramount. It is advisable to allocate a portion of income toward savings consistently. This not only helps individuals reach their financial goals but also cultivates a habit of financial discipline. Creating a dedicated savings plan enables individuals to work toward short-term and long-term objectives, ranging from vacations to retirement.

An emergency fund is another critical component of personal finance. This fund serves as a financial safety net during unexpected events such as job loss or medical emergencies. Financial experts often suggest aiming for three to six months’ worth of living expenses in this fund. Establishing an emergency fund empowers individuals to handle unforeseen expenses without derailing their financial stability.

Tracking financial progress is crucial for maintaining a healthy financial outlook. Regularly reviewing one’s budget and savings allows individuals to identify spending patterns, adjust financial goals, and celebrate milestones. This practice not only boosts accountability but also motivates individuals to stay on course toward their financial aspirations. Setting achievable financial goals, whether short-term or long-term, keeps one’s focus sharp and can significantly enhance their overall financial well-being.

In conclusion, by integrating realistic budgeting, consistent saving, building an emergency fund, and monitoring financial progress, individuals can create a robust financial foundation that supports their journey toward financial freedom.

Strategies for Wealth Growth and Management

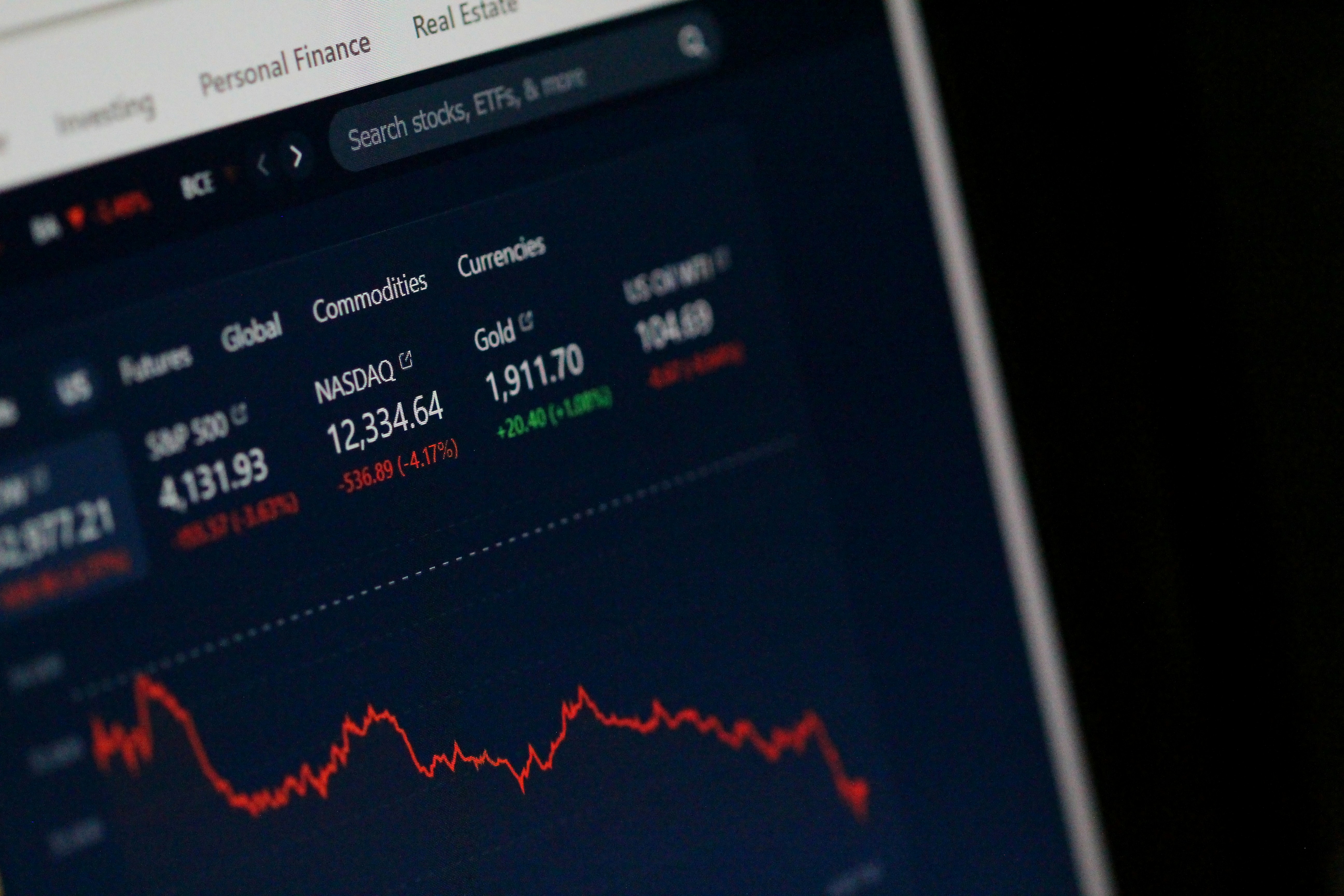

Effective strategies for wealth growth and management are essential for individuals seeking financial stability and freedom. A foundational component of wealth accumulation is understanding various investment vehicles available in the financial market. Common options include stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each of these investments carries distinct characteristics and varying levels of risk. Stocks, for instance, offer the potential for high returns but come with increased volatility. Bonds, on the other hand, are generally considered safer, providing fixed interest income with lower growth potential. Mutual funds and ETFs provide investors with a diversified portfolio managed by professionals, allowing for a more balanced approach suitable for various risk tolerances.

Assessing one’s risk tolerance is crucial when selecting investment strategies. This process involves understanding one’s financial situation, investment goals, and comfort level with market fluctuations. A thoughtful analysis can guide individuals toward appropriate assets, minimizing the likelihood of significant financial distress in tumultuous market conditions. Alongside investment strategies, individuals should also prioritize debt management. High-interest debt, such as credit card debt, can hinder wealth accumulation significantly. Strategies for paying off such debt effectively include the snowball method, which focuses on paying off the smallest debts first, or the avalanche method, which targets debts with the highest interest rates. Building a good credit score is equally important as it influences borrowing options and interest rates.

Furthermore, adopting a comprehensive financial planning approach can greatly enhance an individual’s financial journey. This involves setting financial goals, analyzing income and expenditures, and creating a budget that prioritizes savings and investment. Seeking expert financial advice can provide valuable insights, helping individuals to navigate complex financial landscapes and leverage various financial products to optimize their assets. As such, mastering these wealth growth strategies and management techniques lays the groundwork for a robust financial future.

RELATED POSTS

View all