Financial Empowerment: Your Roadmap to Effective Money Management

February 23, 2025 | by npaul17@gmail.com

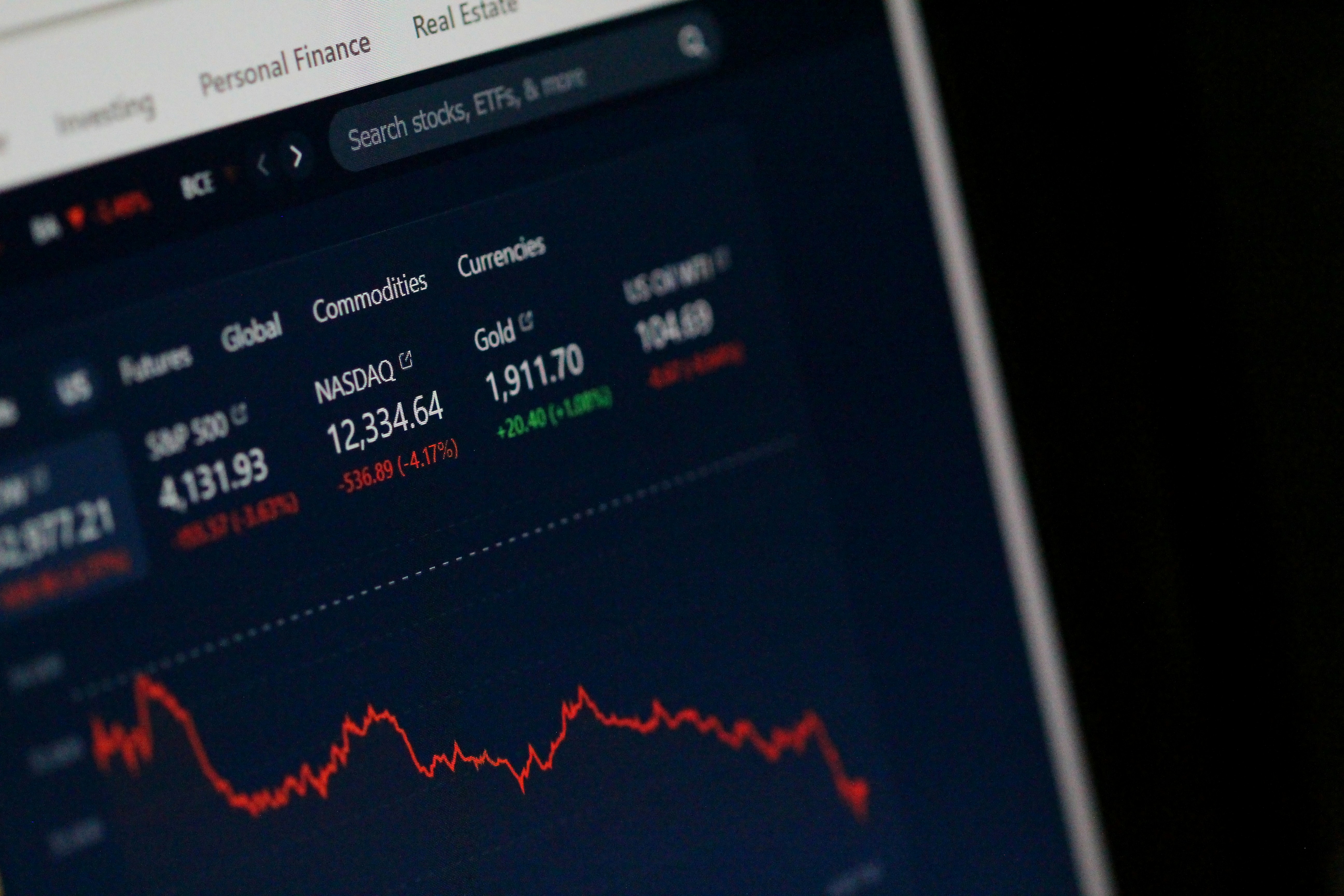

Photo by Anne Nygård on Unsplash

Photo by Anne Nygård on Unsplash Building a Strong Financial Foundation

Establishing a strong financial foundation is crucial for effective money management and long-term financial stability. The first step in this process involves understanding the relationship between income and expenses. A clear comprehension of income sources, whether they are from employment, investments, or other avenues, allows individuals to assess how much they earn and how it translates into available resources. This understanding is directly tied to managing expenses, which include fixed costs like rent or mortgage payments, as well as variable costs like groceries and entertainment.

To achieve a solid financial footing, creating a functional budget is essential. A budget acts as a blueprint for spending and saving, enabling individuals to allocate resources toward essential needs while setting aside funds for discretionary spending. To align a budget with personal goals, it is beneficial to categorize expenses into needs versus wants, ensuring that critical areas such as housing, utilities, and healthcare are prioritized. By integrating personal aspirations—such as travel, further education, or retirement savings—into the budget, individuals can work towards fulfilling their financial objectives while maintaining fiscal responsibility.

Moreover, developing a consistent saving habit is an integral part of building this foundation. Savings not only serve as a financial cushion for emergencies but can also be strategically used for future investments. Financial experts suggest establishing an emergency fund that covers three to six months of living expenses. This fund can provide a safety net during unpredictable circumstances, such as job loss or unexpected medical expenses. Additionally, focusing on saving for long-term goals like retirement or homeownership enhances financial security.

Finally, enhancing financial literacy is vital in this journey. Understanding financial concepts—such as interest rates, investment options, and debt management—empowers individuals to make informed decisions. Assessing one’s current financial situation, recognizing areas that need improvement, and setting achievable financial goals are actionable steps that pave the way to a strong financial foundation. By taking these steps, individuals are better positioned to navigate their financial journeys with confidence and clarity.

Mastering Financial Strategies for Long-Term Success

In today’s dynamic economic environment, mastering advanced financial strategies is essential for effectively enhancing your wealth over time. The foundation of strong financial management lies in understanding smart investing principles, which serve as a pathway to long-term success. By focusing on asset allocation and the significance of diversification, individuals can mitigate risk while capitalizing on potential growth opportunities across various markets.

Diversification, a key tenet of investment strategy, involves spreading investments across different asset classes such as stocks, bonds, and real estate. This approach not only minimizes the impact of market volatility on an overall portfolio but also increases the chances of achieving steady returns. Utilizing various investment vehicles helps create a balanced portfolio suited to your risk tolerance and financial goals.

An equally crucial aspect of financial empowerment is the effective management of debt. Individuals should prioritize understanding the various types of debts they encounter, including high-interest credit cards and long-term loans. Implementing debt repayment strategies, such as the snowball or avalanche method, can significantly help in managing and ultimately reducing liabilities. By maintaining a healthy credit score and avoiding high debt levels, individuals position themselves favorably for future financial endeavors and opportunities.

Effective long-term financial planning also encompasses retirement savings and leveraging appropriate financial tools, such as retirement accounts. Options such as 401(k)s and IRAs not only provide tax advantages but also serve as vital components of a comprehensive financial strategy. Understanding the nuances of these accounts, including contribution limits and investment options, is vital for maximizing growth potential and ensuring financial security in retirement.

Ultimately, the intersection of sound investment principles, strategic debt management, and prudent long-term planning equips individuals with the knowledge to navigate the complex financial landscape. By adopting these advanced strategies, individuals can take decisive steps toward achieving sustainable financial growth and realizing their financial aspirations.

RELATED POSTS

View all